|

ZEPPELIN¡¦S GLOBAL HOME INDEXES: 2011

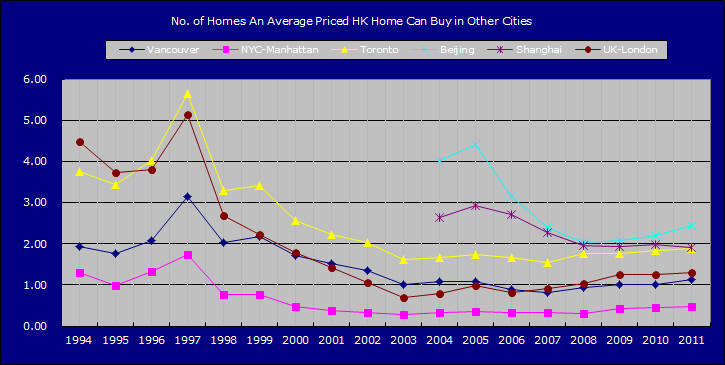

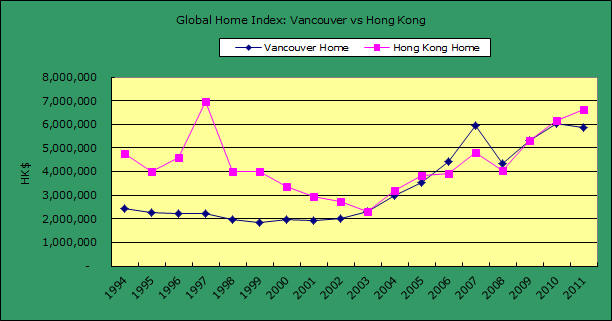

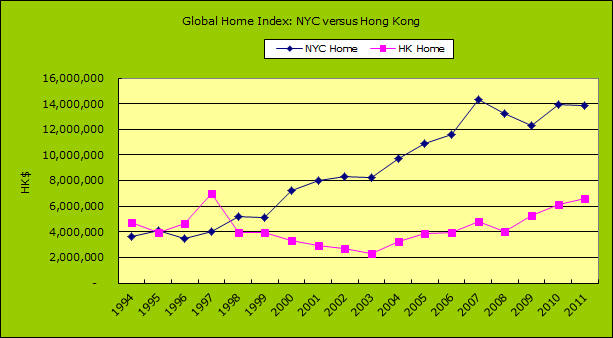

Welcome to our Global Home Indexes webpage! These indexes are created with one thing in mind and this is to give Hong Kong home owners a rough sense of how many prescribed typical overseas homes the average priced Hong Kong home may buy at any given time period. Overtime, perhaps one may observe certain trends among the markets and / or may even compare prices to help in assessing the relative viability of the markets. In the current period, the indexes indicate that an average priced Hong Kong home may be traded for approximately: A) 1.30 homes in London-UK B) 1.14 homes in Greater Vancouver* C) 1.89 homes in Greater Toronto D) 0.48 home in Manhattan of New York City E) 2.45 homes in Metropolitan Beijing F) 1.91 homes in Metropolitan Shanghai Overall, the amount of homes for which a typical Hong Kong home can be traded has increased in 5 of the markets listed, with the exception of Shanghai. Hong Kong residential prices have gained an average of around 8% in 2011. NOTE* for Vancouver, the data published by the Canadian Real Estate Association is adopted.

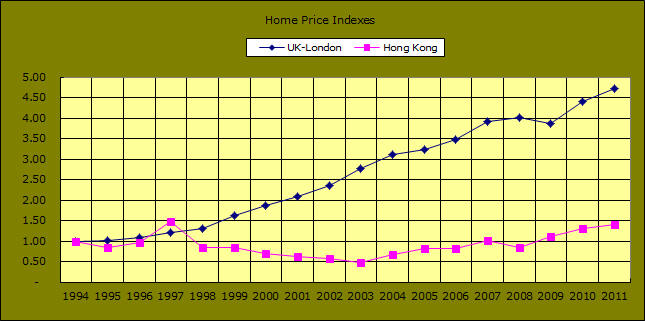

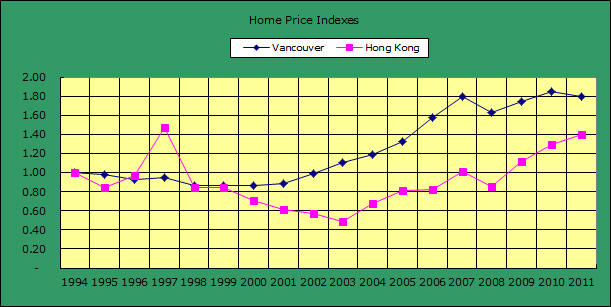

We have also calculated the residential price indexes based on their respective currencies for each of the markets during various combinations of years (note Beijing and Shanghai start from 2004) to see which market would give residential real estate investors the best possible return, based purely on price appreciation, during the various periods. Briefly, Hong Kong prices have performed quite well in the recent 8 years falling only behind Beijing and Shanghai. .

We have also compiled a chart showing the return (Y axis) and risk (X axis) of each market and broadly speaking, the China markets of Hong Kong, Beijing, and Shanghai offer higher returns and higher risks, while the North American and English markets offer lower returns along with lower risks.

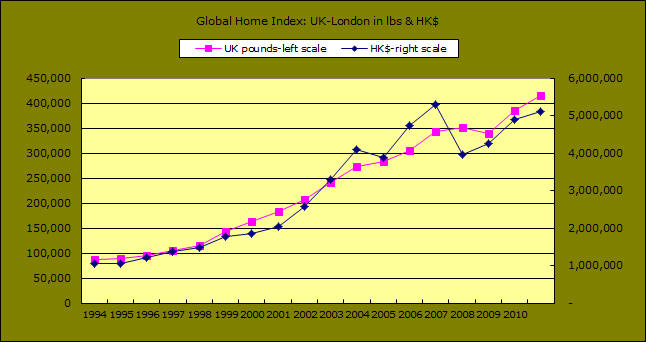

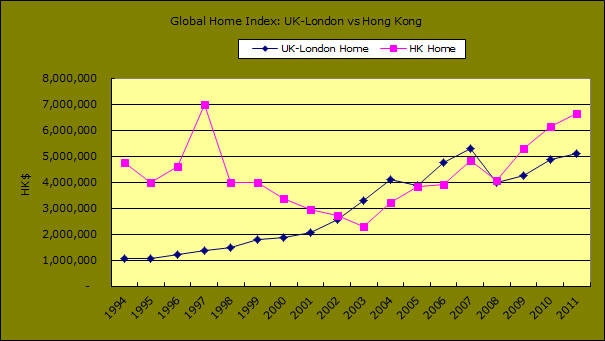

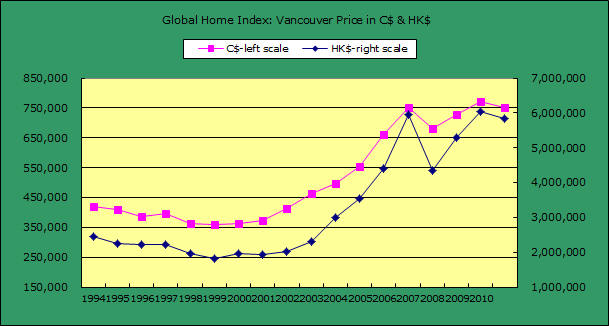

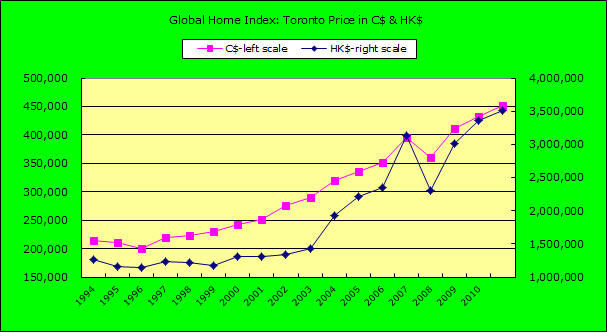

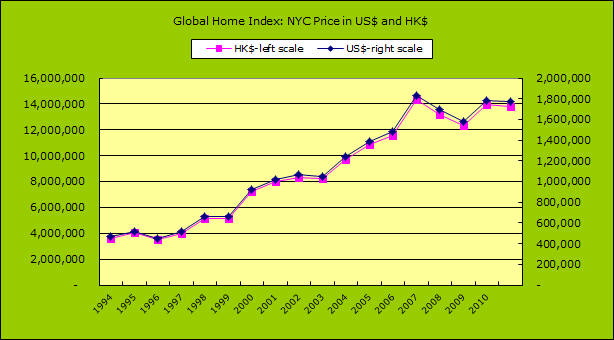

We have also listed the supportive charts below for reference. There are 3 for each market: one being the price of the prescribed typical overseas home in the overseas and Hong Kong currencies; the second being the prices of the prescribed typical overseas home and the average priced Hong Kong home expressed in Hong Kong currency; and the third being their respective indexes:

The following markets or cities have been included to date: A) London in the UK = the prescribed typical home is a 3 bedroom townhouse in a suburban or non-CBD location. B) Greater Vancouver = the prescribed typical home is a 3-4 bedroom single detached house built of timber frame with a single or double garage set in a typical suburban location. C) Greater Toronto = the prescribed typical home is a 4 bedroom single detached house built of timber frame with a single or double garage set in a typical suburban location. D) Manhattan of New York City = the prescribed typical home is a 3 bedroom condominium apartment in a low, medium, or high rise building. E) Metropolitan Beijing = the prescribed typical home is a 3 bedroom condominium apartment in a medium to high rise building set in a suburban or non-CBD location. F) Metropolitan Shanghai = the prescribed typical home is a 3 bedroom condominium apartment in a medium to high rise building set in a suburban or non-CBD location. Other markets or cities may be added later. Please note the following when referring to the indexes: a) These indexes are meant for quick and rough references only and are derived from rough data and simple calculations. These are not products of complex data and sophisticated formulae. b) The data sources are deemed to be reliable and professional yet no comprehensive examination or verification of their accuracy or applicability was done. c) Readers, users, and investors referring to the indexes should bear this in mind and no liability or responsibility of any kind is assumed or taken up by Zeppelin and its staff members, mangers, directors, executives, associates, consultants, advisors, professionals, and the like for errors, omissions, and mistakes that may be contained herein. Proper professional assistance and advice should be sought for individual cases, circumstances, or investment opportunities. d) The selection of the ¡§prescribed¡¨ typical homes in the overseas markets may harbor some degree of subjectivity and each market may differ in the house type being chosen. For instance, while for most North American markets the single detached house is the typical norm, certain cities may have other more prevalent home types ranging from townhouses to high rise condominium apartments. e) Generally average home prices in nominal terms are used and thus there is always the possibility that such average prices may have been skewed up or down in any given time period if there are more expensive or more inexpensive homes transacted during the time period in question. Nonetheless, this possibility may be reduced in some ways if the market is sufficiently huge and / or with the data coming from several periods. f) No adjustments have been made for inflation, deflation, and the like except for currency exchange rates. The following data and information resources have been utilized in deriving the indexes and acknowledgement is hereby given to them: a) Hong Kong Centa-City index of Centaline Agency b) UK Communities and Government sources c) Canadian Real Estate Association website d) Toronto Real Estate Board e) Randi Emmott of ReMax Excellence Realty (website) in Toronto f) Miller Samuel Appraisers and Consultants in New York City g) Centaline (China) website Notes: The article and/or content contained herein are for general reference only and are not meant to substitute for proper professional advice and/or due diligence. The author(s) and Zeppelin, including its staff, associates, consultants, executives and the like do not accept any responsibility or liability for losses, damages, claims and the like arising out of the use or reference to the content contained herein. |

Phone (852) 37576388 Fax (852) 37576399 E-mail contact@real-estate-tech.com

Address c/o Zeppelin, Unit 1007, 10/F, CCT Telecom Building, 11 Wo Shing Street, Shatin, NT, Hong Kong

Copyright rests with Zeppelin and/or relevant authors