|

Hong Kong REITS: Not Too Correlated with One Another Stephen Chung Managing DirectorZeppelin Real Estate Analysis LimitedFebruary 2008

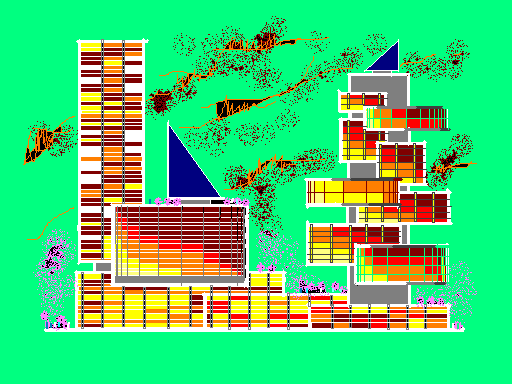

There are now 7 REITS listed* in Hong Kong, namely the LINK REIT, Prosperity REIT, GZI REIT, Champion REIT, Sunlight REIT, Regal REIT, and the RREEF REIT. Save for GZI and RREEF which are involved in Mainland China real estate, the rest own, operate, and manage Hong Kong properties. Out of curiosity, we have conducted simple correlations between these 7 REITS using published Yahoo! Finance daily closed stock price data from the past 3 months to see if these REITS go up and down quite uniformly or otherwise. Here are the results:

Based on the indicative R2, while some REITS appear to have correlations of some significance between them, e.g. LINK and Prosperity, Sunlight and Prosperity, or Champion with both Prosperity and Sunlight, the others do not exhibit much correlation. RREEFF, which invests in Mainland China, appears to go the other way when correlated with REITS which invest in Hong Kong properties but does not exhibit a strong enough opposite direction. We have also checked out whether the stock price has any bearing with the volume traded for each REIT and here are the results:

Again, there seems little correlation except in the case of LINK and Prosperity. We have also compared the 7 REITS to the stock prices of a couple of the largest and most popular publicly listed real estate developers, namely Cheung Kong and Sun Hung Kai Properties. Here are the results:

Overall, apart from e.g. Champion showing some significant correlation with Sun Hung Kai Properties, most do not appear to synch much, even if in an opposite way, with these 2 publicly listed real estate developers. Perhaps this reflects the market tendency to differentiate, rightly in a way, between real estate development operations (the Cheung Kong, the Su Hung Kai Properties etc) and pure real estate investment in existing property operations (the Hong Kong listed REITS). Admittedly, compared to traditional publicly listed real estate developers, REIT stocks appear less sought after or traded and REIT stock prices collectively do not tend to follow the real estate market sentiment as closely. Capitalization-wise, REITS collectively are small compared to the publicly listed real estate developers. Nonetheless, where properly created, priced, and structured, REITS could be good investment vehicles for investors seeking relatively steady and regular income streams, in part because REITS are mandated to distribute a minimum portion of its income, by way of rental income or real estate disposition, as dividend to their shareholders. Given REIT stock prices generally do not seem to mimic those of the publicly listed real estate developers, REITS may be used as counter-balances or risk-reduction tools by investors whose stock portfolios contain publicly listed real estate developers, in particular to those investors who wish to keep to a real estate investment theme. As to the relatively weak relationship among the REITS themselves, this may mean REIT investors who invest in a number of the 7 available REITS may face less overall risk than investors who invest in a number of the publicly listed real estate developers. With proper utilization, REITS are a good choice for the graying population, retirees and semi-retirees included, who may be inclined to trade huge potential capital gains for stable and regular dividend income streams, and a peace of mind. Notes: The article and/or content contained herein are for general reference only and are not meant to substitute for proper professional advice and/or due diligence. The author(s) and Zeppelin, including its staff, associates, consultants, executives and the like do not accept any responsibility or liability for losses, damages, claims and the like arising out of the use or reference to the content contained herein. |

Phone (852) 37576388 Fax (852) 37576399 E-mail contact@real-estate-tech.com

Address c/o Zeppelin, Unit 1007, 10/F, CCT Telecom Building, 11 Wo Shing Street, Shatin, NT, Hong Kong

Copyright rests with Zeppelin and/or relevant authors