|

Decoupling? What Decoupling? Stephen Chung Managing DirectorZeppelin Real Estate Analysis LimitedFebruary 2008

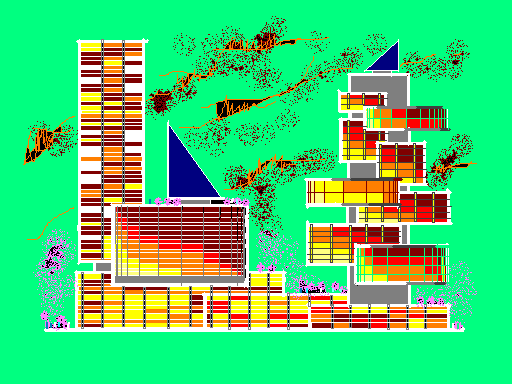

The recent sub-prime mortgage mess in the developed economies, namely the USA and related European countries, has prompted many to ponder if its reach would extend to the rest of the world, especially the developing economies or emerging markets in Asia. Some commentators cited decoupling as a reason that the sub-prime issue would not affect Asian emerging markets, China included. First, these are 2 different economic blocks, one being developed and the other still developing. Second, while the developed block-USA is a debtor economy, the developing block-China has tons of financial reserves. Also, many of these emerging markets do not appear to have invested much in such sub-prime or bundled-securitized financial products. Not being an economist, the best which your humble author could comprehend from such reasoning above is that these commentators are telling us the sub-prime issue will not affect Asia-China much because these 2 economic blocks, the developed and the developing-emerging, are functioning-operating quite independently and separately. Fine, but hold on a second, aren’t we supposed to be living in an age of ‘globalization’ which means the world is more connected in every way than before? Perhaps it was true that 500 hundred years ago what the then French king did had little bearing on China, yet now it seems all it takes is one little known French investment trader to send financial shockwaves throughout the global system. Hmm…something does not quite synch with the decoupling theory. It is one thing to say that the sub-prime issue is not huge enough to really affect the whole world, and economists appear divided on this even today, but it is another thing to say the sub-prime issue does not matter because the economies-markets are decoupled. Are they? Out of curiosity, your humble author decided to do a quick and dirty calculation using simple correlations based on published stock market data in Yahoo! Finance. 4 stock market indexes are selected; Hong Kong’s Hang Seng, Shanghai’s Composite, Dow Jones Industrial, and the German DAX, and the periods date from January 2000 to January this year (2008). The index figures used are monthly and the adjusted closed indexes are adopted. Here are some observations and results: A) In the last 8 years from January 2000 to January 2008 = the correlations between the 4 markets are not insignificant and they are also going in the same direction

B) In the last 4 years from January 2004 to January 2008 = if the time period is shortened to include only the last 4 years, the correlations have grown even higher across the board

C) In the last 2 years from January 2006 to January 2008 = the correlations by and large remain as significant as those seen in the 4 year scenario

D) In the past year from January 2007 to January 2008 = the correlations have gone smaller (than in the 4 year or 2 year scenarios) yet cannot be described as insignificant in themselves. At best, one can only speculate that should this decreasing-correlation trend continue, the 4 stock markets may become ‘decoupled’ one day or during certain period, but this day or period is not now [do also note a one-year data stream is less representative compared to longer data streams]

Stating the obvious, a significant correlation in itself does not imply there is a cause-effect between any two markets because there is always the chance that it is simply a coincidence, and it may also be argued that stock markets do not cover or represent all there are in economies. True but then again stock markets are an important component in many economies and that stock markets, rightly or wrongly, do reflect the collective thinking of related market participants. Furthermore, commentators who suggested decoupling are very likely to have financial-stock markets (and the assets they involve) in mind when they make the suggestion. Summing up, there is no sign or symptom which suggests there is a meaningful decoupling between the developed-USA and developing-China markets, based on the selected stock market data above. IN SHORT, THEY ARE NOT DECOUPLED, AT LEAST NOT STOCK MARKET-WISE. Perhaps it is more prudent to assume that stock markets tend to follow or mimic one another AND IF this does not happen, i.e. stock markets in China not following the USA trend, treat it as a kind of bonus rather than a decoupled fact. Notes: The article and/or content contained herein are for general reference only and are not meant to substitute for proper professional advice and/or due diligence. The author(s) and Zeppelin, including its staff, associates, consultants, executives and the like do not accept any responsibility or liability for losses, damages, claims and the like arising out of the use or reference to the content contained herein. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Phone (852) 37576388 Fax (852) 37576399 E-mail contact@real-estate-tech.com

Address c/o Zeppelin, Unit 1007, 10/F, CCT Telecom Building, 11 Wo Shing Street, Shatin, NT, Hong Kong

Copyright rests with Zeppelin and/or relevant authors