|

Hong Kong Residential Real Estate: Average Prices still within Explainable Range Stephen Chung Managing DirectorZeppelin Real Estate Analysis LimitedJanuary 2008

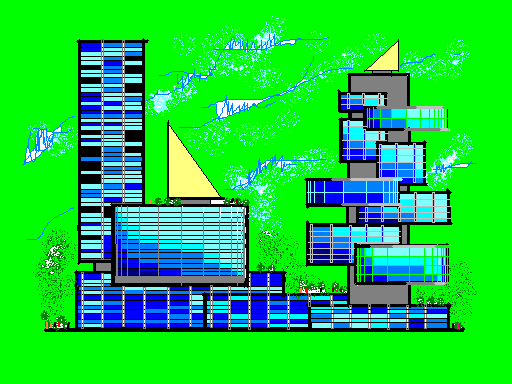

Residential prices have been shooting up quick in the recent one month or two with the better quality and Hong Kong Island Side residential properties leading the pack. How fast and how much? Refer to this webpage at www.centanet.com = http://www.centadata.com/cci/cci_e.htm. Friends and investor clients have been posing questions on whether such price rises are sustainable and if so, how much further these prices can go. These are multi-million dollar questions which cannot be fully answered in a short article like this one. Nonetheless, interested readers can take a look at this chart:

For both the mathematically minded and less such minded, the above chart shows: a) In dark blue = the residential price indexes from 1994 to 2007 compiled by Centaline Real Estate Agency and found in www.centanet.com b) In red = the average of the indexes during the period ¡@ c) In yellow = the upper (+ve) standard deviation from the average ¡@ d) In bright or light blue = the lower (-ve) standard deviation from the average Here are a few observations: 1) The index for 2007 stands at around 66 which is above the average of the period BUT is still under the upper standard deviation value of around 72 2) Assuming if the price is just to reach this upper standard deviation value of 72 from the current level of 66, prices in general may still have (72-66) / 66 = some 9% to go (up) 3) However, when one looks back at 1997, one would see the 1997 figure of 100 is way above the upper standard deviation value of 72 [100-72=28], especially when compared to the difference between the lowest trough of 33 and the lower standard deviation value of around 40 [40-33=7][Note the 28 to 7 difference between the two comparisons] 4) In short, it does seem the market, at least based on this one instance alone, behaves more unexplainably when it is hot than when it is cool 5) Hence, if one is factor in some degree of ¡¥market exuberance¡¦, say just half the difference between the 1997 index and the upper standard deviation value, i.e. 28 / 2 = 14 index points above the upper standard deviation value, then the index would have (((72+14)-66)/66) = some 30% more to go (up) No doubt the above is theoretically flawed and not the best possible way to gauge the market, yet it is easy to calculate and probably contains at least some validity when compared to promotional tones quoting increases of 10% or 20% etc. Also, keep an eye on the US$ because the above expectation depends on it becoming weaker or at least staying weak. Notes: The article and/or content contained herein are for general reference only and are not meant to substitute for proper professional advice and/or due diligence. The author(s) and Zeppelin, including its staff, associates, consultants, executives and the like do not accept any responsibility or liability for losses, damages, claims and the like arising out of the use or reference to the content contained herein. |

Phone (852) 37576388 Fax (852) 37576399 E-mail contact@real-estate-tech.com

Address c/o Zeppelin, Unit 1007, 10/F, CCT Telecom Building, 11 Wo Shing Street, Shatin, NT, Hong Kong

Copyright rests with Zeppelin and/or relevant authors